For the second consecutive year, the France Esports association, accompanied by Médiamétrie, presents the results of its national esports barometer. This survey aims at identifying and gaining a better understanding of the behaviour of French esports players and spectators. As a necessary tool for the ecosystem and the esports industry, the previous edition of France Esports Barometer provided as much information as it raised new questions. The association therefore wished to build on the work carried out last year by proposing a more complete, more precise and more detailed 2019 edition of the study.

You can watch here the speech presenting the first figures of France Esports 2019 barometer by Nicolas Besombes, Vice President of France Esports. This communication took place as an introduction to the Esports Summit 2019 at the opening of Paris Games Week. It was followed by a speech by Cédric O, Secretary of State for Digital Technology, and Sophie Cluzel, Secretary of State to the Prime Minister, in charge of Disabled People, who spoke about the future of esports in France.

Presentation of the main results

Player Profiles

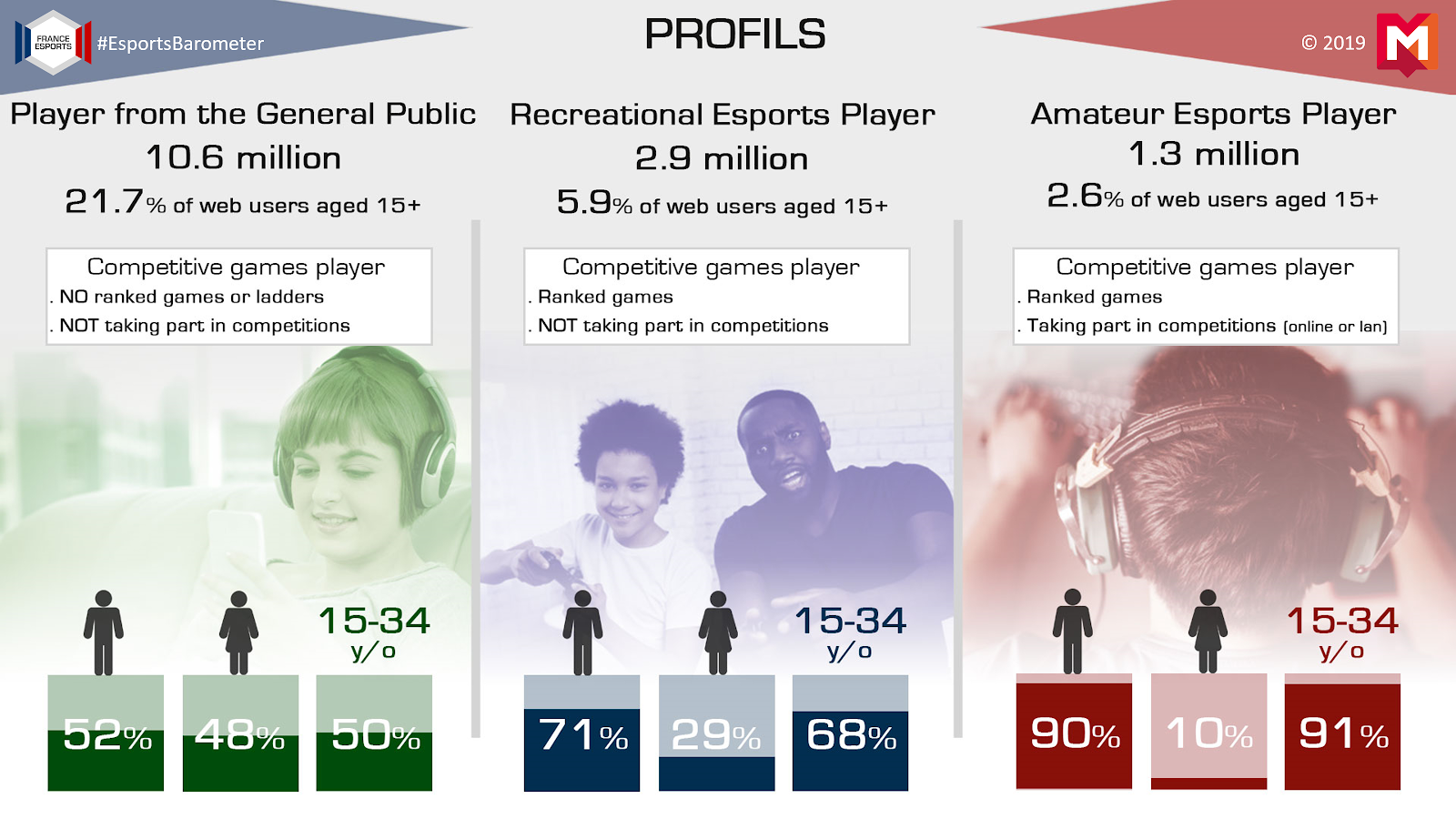

The data collected revealed three main categories of players according to the way in which they play competitive video games:

- The « Players from the General Public »: these are the respondents who say they play video games that allow them to play against other players, but no ranked games, and without registering for organized competitions. This first category represents 21.7% of the population surveyed and, by extrapolation, represents 10.6 million people in France. This group is almost balanced in terms of the proportion of men (52%) and women (48%), and is made up of half of individuals aged between 15 and 34 (50%). Finally, 34% of them come from higher socio-professional categories.

- The « Recreational Esports Players »: these are the respondents who say they play video games that allow them to play against other players, who take part in ranked games (ranked and ladders), but without registering for organised competitions. This second category represents 5.9% of the population surveyed and, by extrapolation, represents 2.9 million people in France. Two-thirds of this group are men (71%) and individuals aged between 15 and 34 (68%). Finally, 27% of them come from higher socio-professional categories.

- The “Amateur Esports Players »: these are the respondents who say they play video games that allow them to compete against other players, almost all of whom take part in ranked and ladder games, and who have already registered for organised competitions (online or in LANs). This last category represents 2.6% of the population surveyed and, by extrapolation, 1.3 million people in France. This group is almost exclusively composed of men (90%) and individuals aged 15 to 34 (91%). Finally, a majority of 54% of them come from higher socio-professional categories.

Sports and Cultural Habits

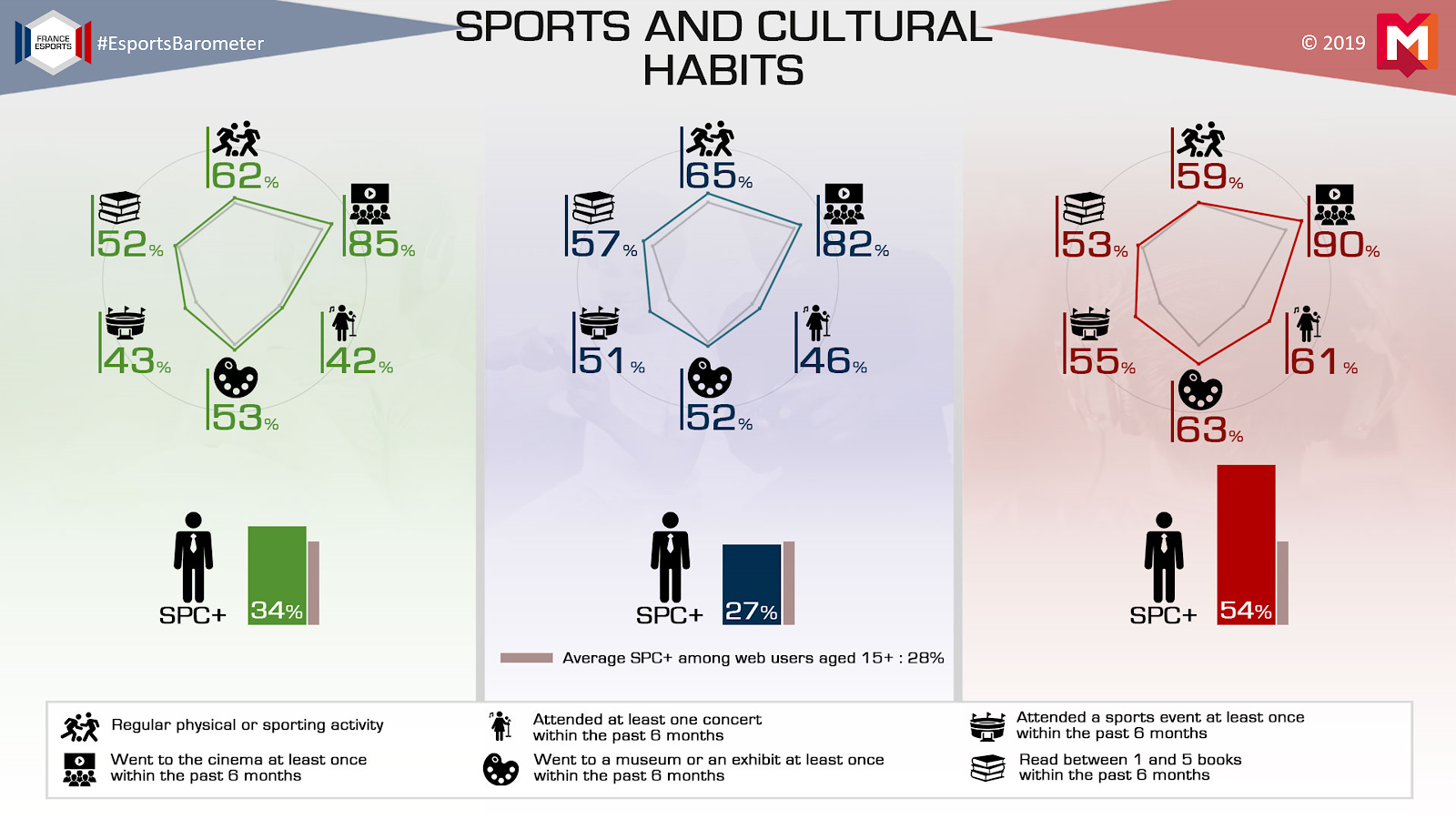

Regardless of the category of players, and regardless of the indicator chosen, all three groups have results equal to or than the French population:

- They are more likely to engage in regular physical activity;

- They are more likely to go to on-site sporting events;

- They are more likely to go to the movies;

- They are more likely to go to a concert;

- They are more likely to visit a museum or an exhibit;

- They are more likely to read books.

The stereotypical representation of a teenager locked up in his room and alienated by video games to the point of having the latter as his only hobby turns out to be very caricatural. Video games and their competitive practice are thus part of the population’s many socio-cultural and sporting leisure activities, and the player is a complex individual with multiple activities.

Practice Trends

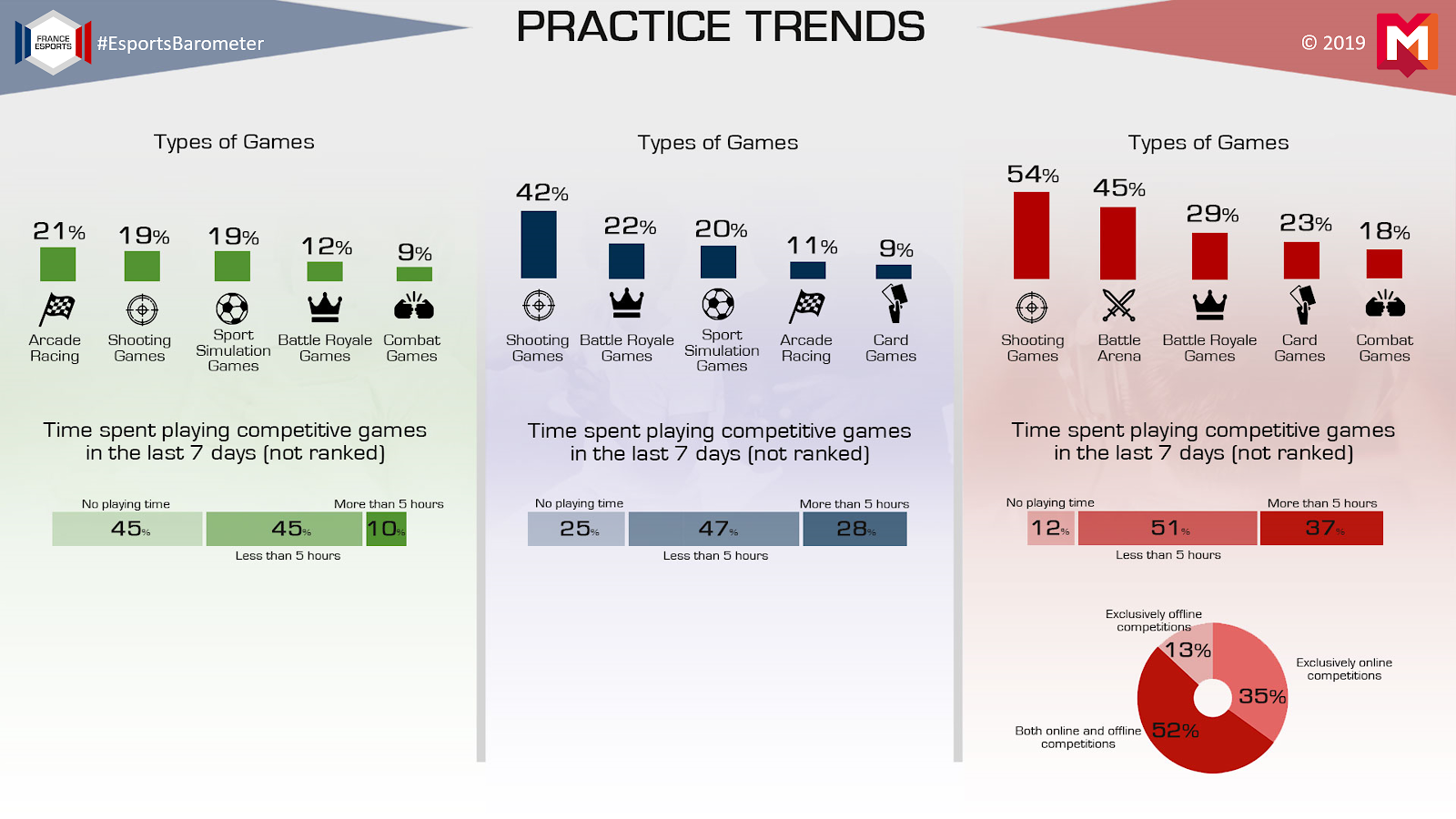

The most video games and esports genres played and the time given to practice differ widely between the three identified populations:

The « Players from the General Public » declare to play in order of preference:

- Arcade racing games (such as Trackmania or Mario Kart) for 21%,

- Shooting games (such as Splatoon or Overwatch) for 19%,

- Sports Simulation games (such as FIFA or NBA2K) for 19%,

- Battle Royale games (such as Fortnite or Apex Legends) for 12%,

- Fighting games (such as Smash Bros Ultimate or Dragon Ball FighterZ) for 9%.

As for non-ranked games, almost half of this group (45%) has not played in the last seven days. The same proportion spent less than five hours (45%), and a tiny fraction (10%) spent more than five hours playing competitive video games.

The « Recreational Esports Players » declare to play in order of preference:

- Shooting games (such as Counter-Strike or Call of Duty) for 42%,

- Battle Royale games (such as Fortnite or PUBG) for 22%,

- Sports Simulation games (such as FIFA or PES) for 20%,

- Sports Arcade games (such as Trackmania or Rocket League) for 11%,

- Card games (such as Hearthstone or MTG Arena) for 9%.

As for non-ranked games, a quarter of this group (25%) has not played in the last seven days. The same proportion spent more than five hours (28%), while the majority (47%) spent less than five hours playing competitive video games.

The « Amateur Esports Players » declare to play in order of preference:

- Shooting games (such as Counter-Strike or Call of Duty) for 54%,

- MOBAs (such as League of Legends or DOTA 2) for 45%,

- Battle Royale games (such as Fortnite or PUBG) for 29%,

- Card games (such as Hearthstone or MTG Arena) for 23%,

- Fighting games (such as Street Fighter V or Tekken 7) for 18%.

Concerning the non-ranked games, a minority of this group (12%) has not played in the last seven days, but half (51%) has spent less than five hours playing them, while more than a third (37%) has spent more than five hours playing competitive video games.

Among members of this last category who have participated in at least one competition in the last twelve months, one-third (35%) participated exclusively in online competitions, a minority (13%) participated exclusively in physical competitions (LANs), while the majority (52%) participated in both.

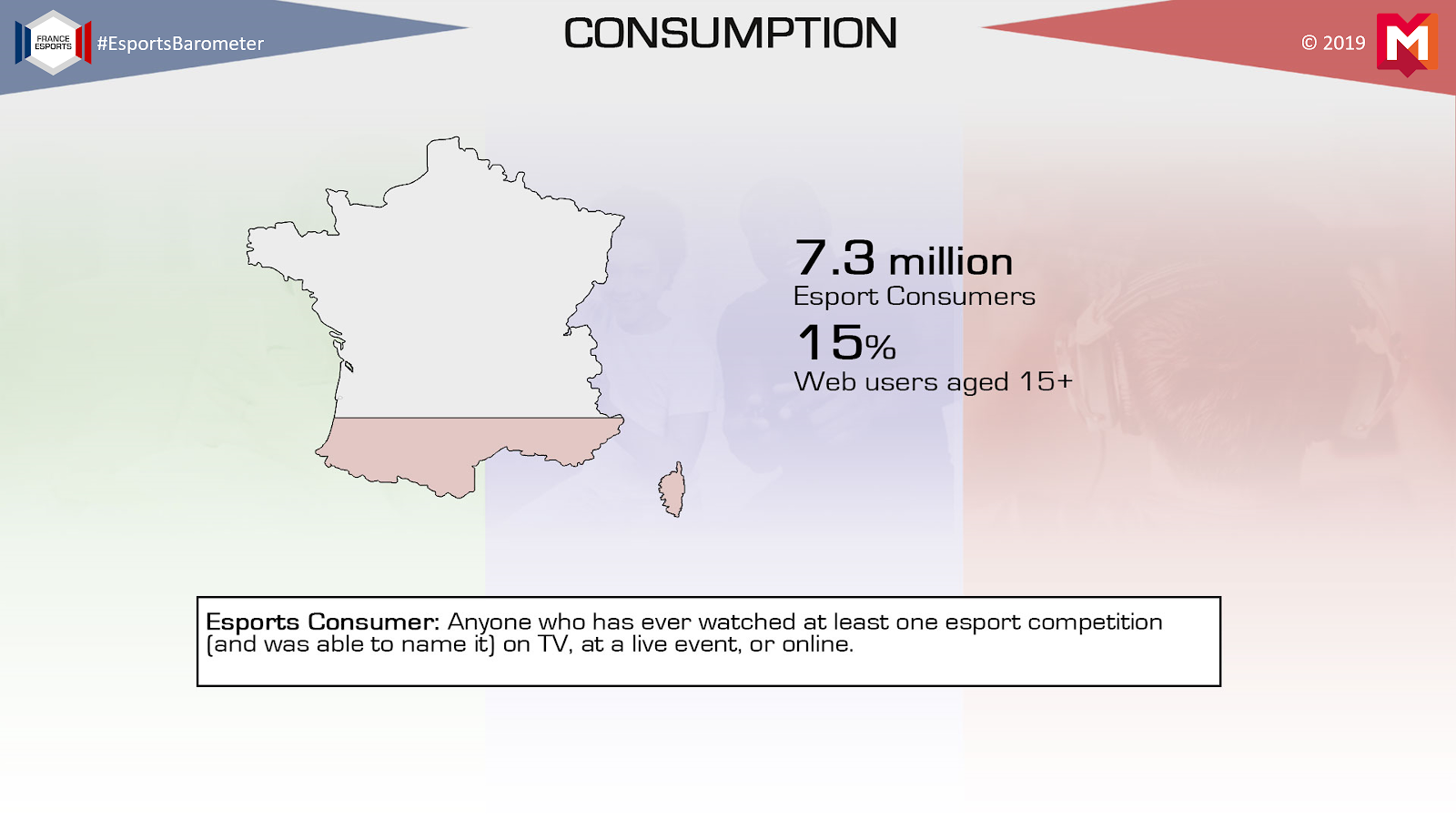

Consumption

Esports « Consumers » are defined as people who have already watched at least one organised video game competition (which they were able to name), either directly on-site, online on the Internet (live or replay platforms) or on television. These are 15% of the respondents who were identified as such, which is equivalent by extrapolation to 7.3 million French people.

Consumption Trends

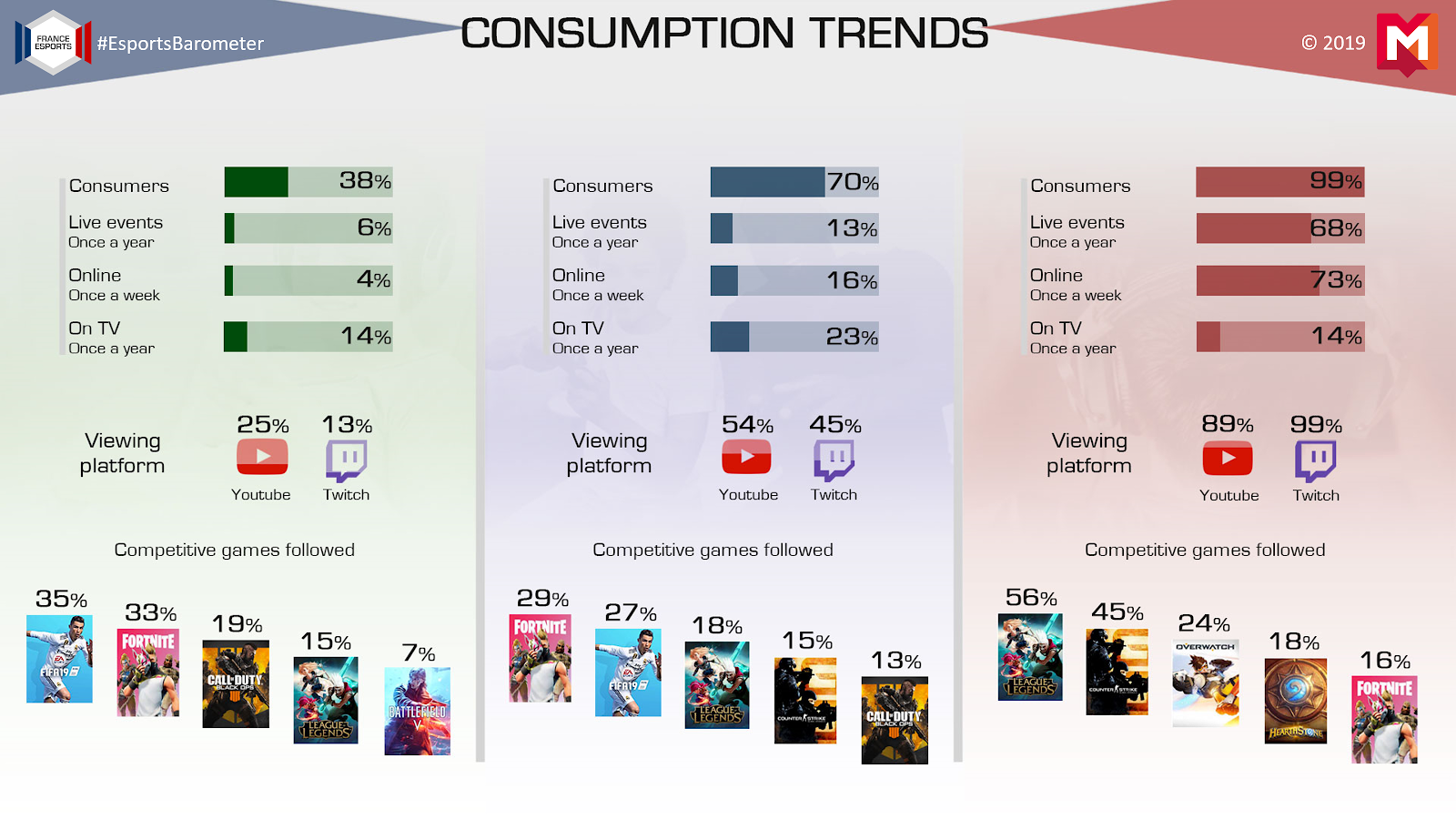

Here again, the trends of this consumption differ drastically according to the three populations of players, and the commitment of these latter also varies considerably:

Only 38% of the « Players from the General Public » are esports consumers. Only 6% have attended an event physically in the last twelve months and 4% have watched a competition on the Internet in the last seven days. Only television seems to be a medium (relatively) used by 14% of this group.

On the Internet, YouTube is the preferred viewing platform (25%), especially for rebroadcasting, while Twitch is little used (13%).

The « Players from the General Public » mainly report following:

- FIFA (35%)

- Fortnite Battle Royale (33%)

- Call of Duty (19%)

- League of Legends (15%)

- Battlefield (7%)

Regarding the « Recreational Esports Players », more than two-thirds (70%) are esports consumers. Much more committed, 13% have attended a physical event in the previous year, 16% have watched competitions on the Internet in the last seven days, and there again, nearly a quarter (23%) prefer to watch competitions on television.

On the Internet, the YouTube platform (54%) remains slightly preferred to Twitch (45%).

The « Recreational Esports Players » mainly report following:

- Fortnite Battle Royale (29%)

- FIFA (27%)

- League of Legends (18%)

- Counter-Strike: Global Offensive (15%)

- Call of Duty (13%)

Finally, the « Amateur Esports Players » proved to be the most radically committed category since almost all respondents (99%) watch video game competitions. More than two-thirds (68%) went to a physical event in the previous year and 73% said they had watched competitions on the Internet in the last seven days. On the other hand, television is particularly ignored by this group, with only 14% reporting having used this medium to watch competitions in the last twelve months.

On the Internet, the Twitch platform is favoured by almost the entire population (99%), ahead of YouTube, although it is still used by 89% of respondents.

The « Amateur Esports Players » mainly report following:

- League of Legends (56%)

- Counter-Strike : Global Offensive (45%)

- Overwatch (24%)

- Hearthstone (18%)

- Fortnite Battle Royale (16%)

Objectives

The main objectives of the Barometer are to define and quantify the different categories of esport players and fans according to their practices and consumption, and to measure their evolution over time in order to identify certain trends. The study is thus conceived as a tool intended for the French esports stakeholders and ecosystem, and is therefore deliberately national, wide-ranging and uncorrelated with commercial objectives.

Methods

Since the first edition, the association has made it a point of honour to ensure that the methodology is rigorously constructed to produce the most reliable data possible. France Esports and Médiamétrie have therefore made significant changes to the methodology used last year. Two elements have thus been improved:

- The wording of the questions: It appears that there is no real consensus about the definition of “esports” among communities, key stakeholders and the general public, and that the term can therefore be interpreted in different ways and lead to confusion. In order to avoid this, it was decided to remove the term « esports » from almost all of the survey. Instead, other formulations referring to « playing or watching organised video game competitions to compete with other players » were preferred so that the respondents would be able to answer each question without difficulty and so that the questions would be understood in the same way by all.

- The addition of an oversample: this is certainly the most important modification as it allows for more accurate and complementary data. In fact, to the main sample of 4022 Internet users aged 15 and over representative of the French population, a second sample of 328 Internet users aged 15 and over from the Players’ Members of France Esports was added. This more specific oversample, made up of people who were already familiar with esports, made it possible in particular to collect reliable and solid data (as it was sufficiently large) on the characteristics of players who had already participated in online or LAN competitions (« Amateurs Esports Players »). The main sample allowed (i) to identify the different categories, (ii) to assess the reputation of the sport, and (iii) to collect data from players who participate in classified games but do not enter competitions (« Recreational Esports Players ») and those who do not play ranked games or participate to organised competitions (« Players from the General Public »).

The two samples were interviewed and processed separately using a self-administered online survey between June 18 and July 5, 2019 for the primary sample and July 3-17, 2019 for the secondary sample. The information thus collected from the respondents concerned:

- their socio-demographic characteristics (age, sex, SPC, place of residence, etc.) ;

- their knowledge and representation of esports (level of awareness in society, confusion about the term, etc.);

- their consumption of video game competitions (competitions followed, time allowed, platforms used, motivations, support, etc.);

- their practice of video games that allow players to compete against each others (games played, mode of play, participation in competitions, support used, motivations, etc.) ;

- their cultural and sporting habits (practice of sports, cultural outings, etc.).

Limits

As with all surveys, the Barometer does not deviate from a few limits that it is important to share in all transparency and which it is necessary to be aware of when interpreting the results:

- The survey was distributed online: only individuals connected to the Internet were questioned.

- Both samples are composed of individuals aged 15 and over: the consumption and practices of younger children were not measured.

- The survey is a self-declarative measurement instrument: although a maximum of precautions were taken in the construction of the survey, behaviours deemed socially « desirable » (such as for example « going regularly to the museum ») may lead to an overestimation (or over-reporting) of the respondents, while on the contrary, behaviours deemed socially « undesirable » (such as for example « playing more than twenty hours a week at video games ») may tend to be underestimated (or under-reported) by the respondents.

- The over-sample is not representative of the French population: the second sample composed of 328 respondents has specific characteristics that are not representative of the entire population of French Internet users aged 15 and over.

Conclusion

The results of this new edition of the Barometer finally reveal detailed information on the different populations of players, their numbers, their behaviours and their engagement as spectators and as practitioners. The addition of the second sample has made it possible to refine the data collected and to bring nuance and precision to the « Amateur Esports Players » category. This public computer graphics and the results presented here represent only a small part of the data available in the « Extended Barometer » reserved for paying members of the association.

France Esports would like the Barometer to be useful for all the French esports stakeholders, whether they are associations, commercial, economic or institutional organisations. Remarks and suggestions are of course welcome, and the association is at the disposal of all to take them into consideration.